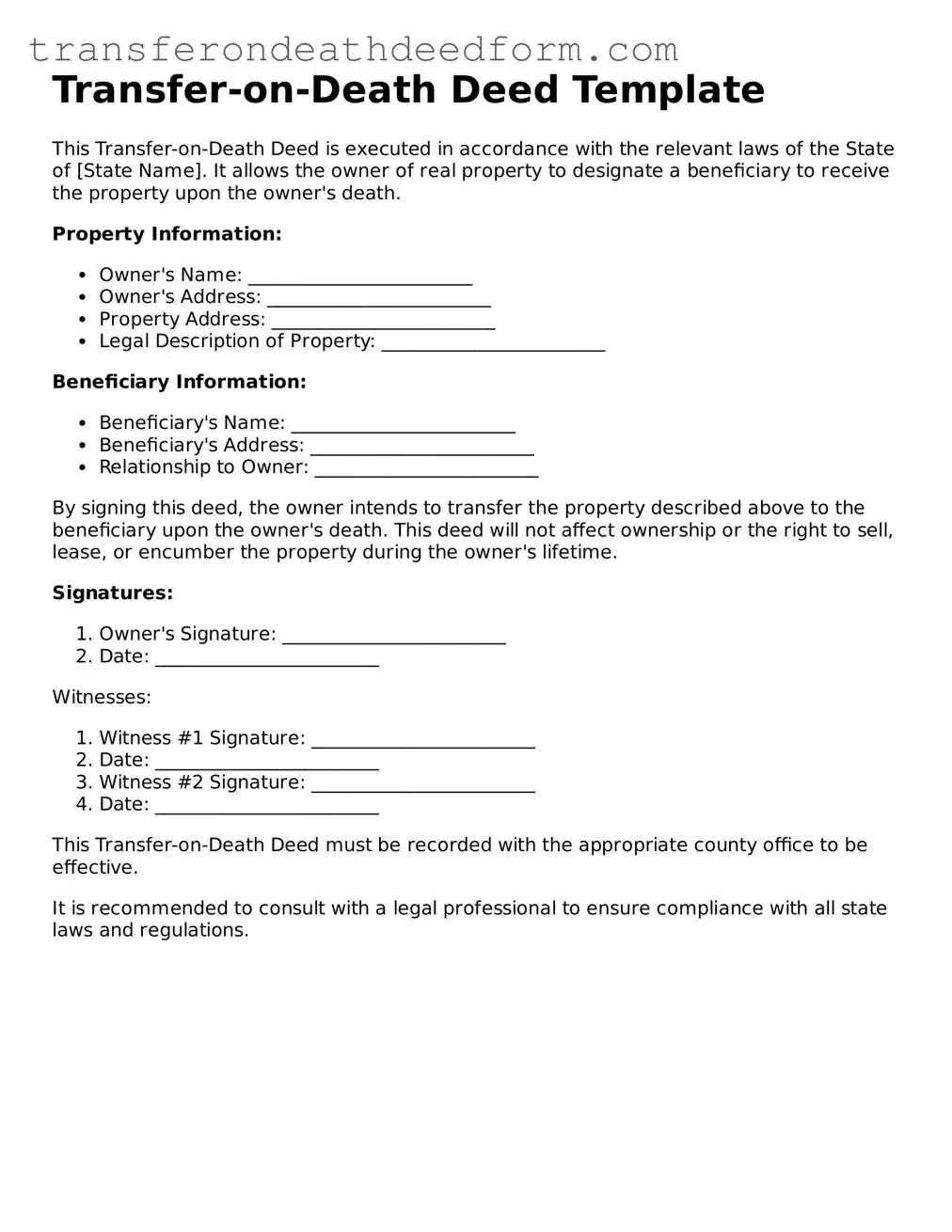

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the relevant laws of the State of [State Name]. It allows the owner of real property to designate a beneficiary to receive the property upon the owner's death.

Property Information:

- Owner's Name: ________________________

- Owner's Address: ________________________

- Property Address: ________________________

- Legal Description of Property: ________________________

Beneficiary Information:

- Beneficiary's Name: ________________________

- Beneficiary's Address: ________________________

- Relationship to Owner: ________________________

By signing this deed, the owner intends to transfer the property described above to the beneficiary upon the owner's death. This deed will not affect ownership or the right to sell, lease, or encumber the property during the owner's lifetime.

Signatures:

- Owner's Signature: ________________________

- Date: ________________________

Witnesses:

- Witness #1 Signature: ________________________

- Date: ________________________

- Witness #2 Signature: ________________________

- Date: ________________________

This Transfer-on-Death Deed must be recorded with the appropriate county office to be effective.

It is recommended to consult with a legal professional to ensure compliance with all state laws and regulations.