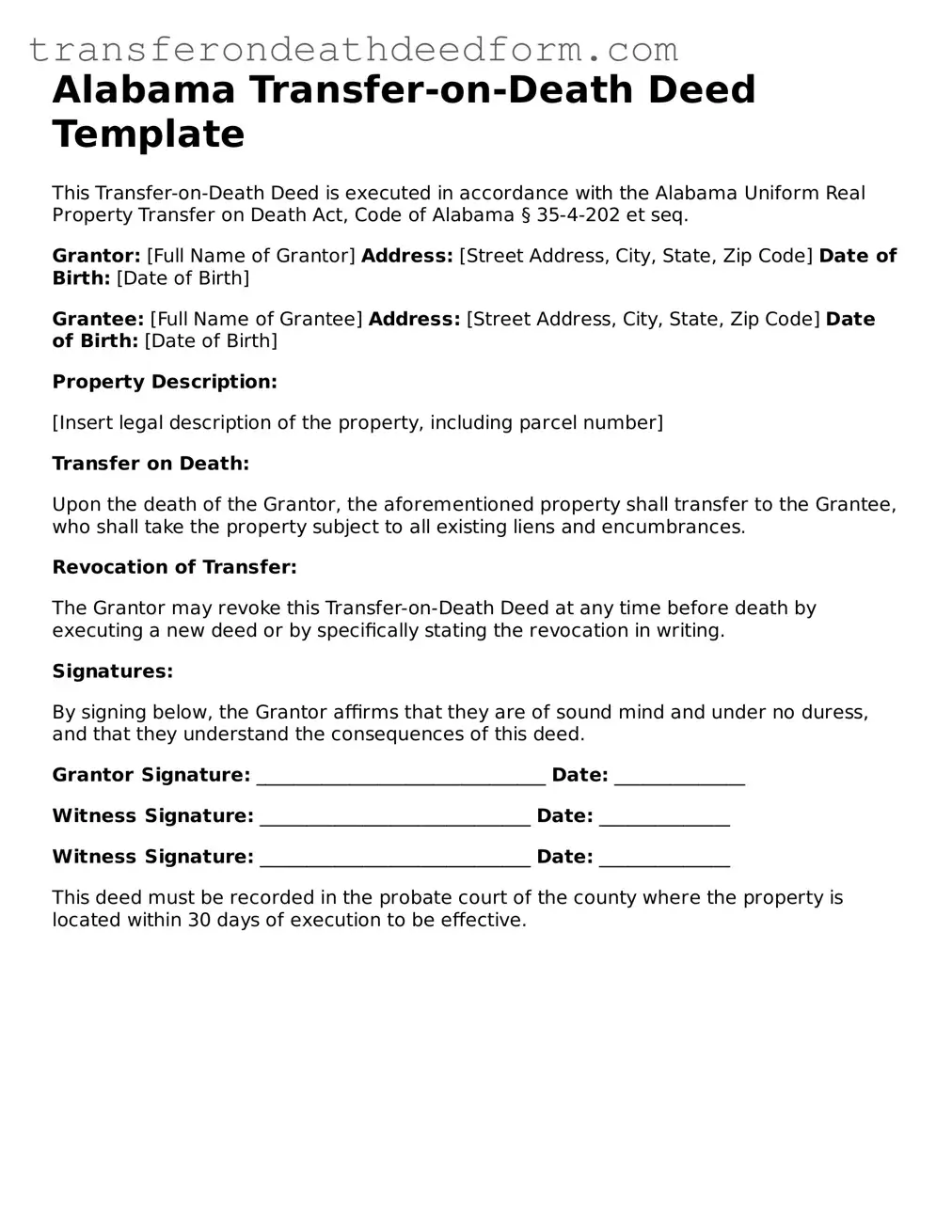

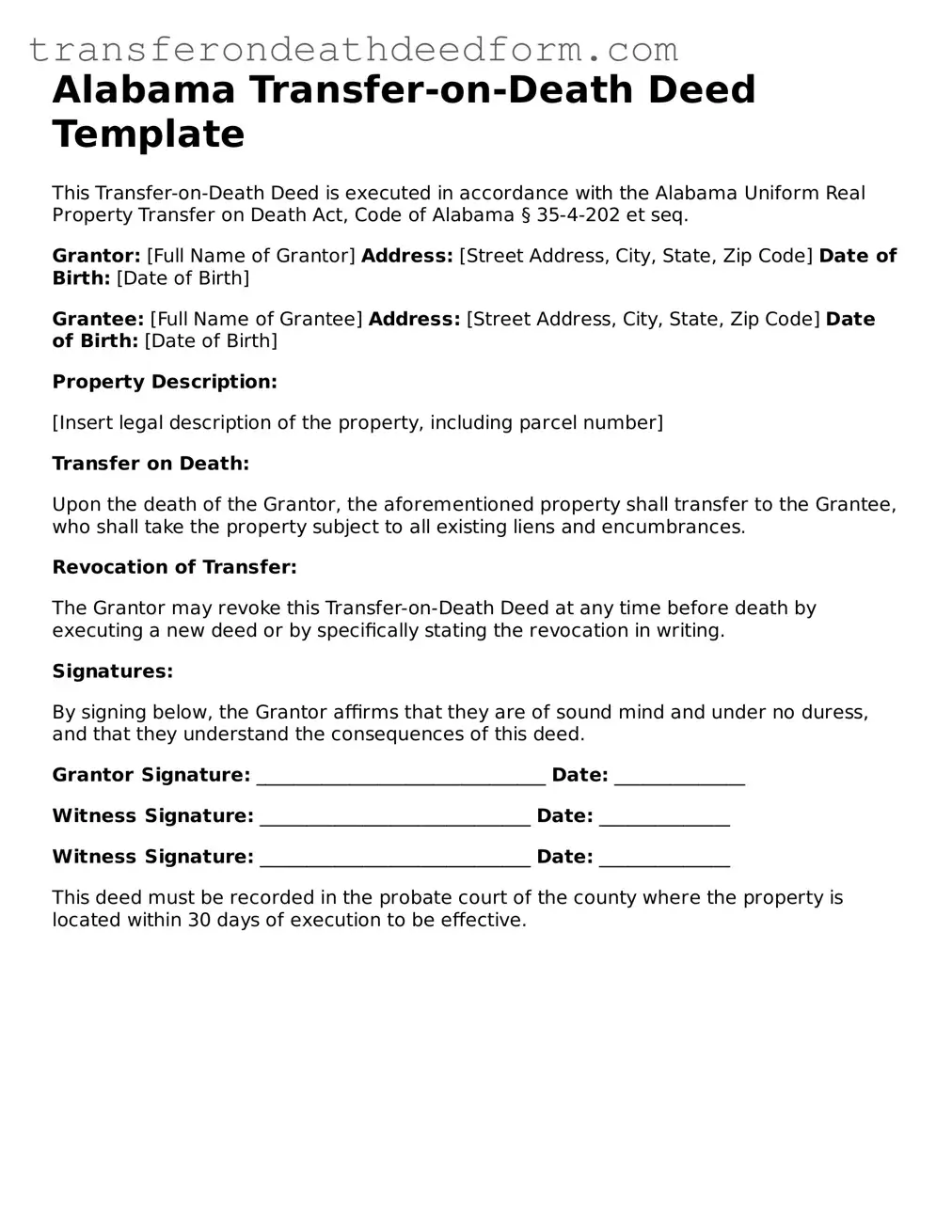

Transfer-on-Death Deed Form for Alabama

The Alabama Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This deed provides a straightforward way to ensure that your property passes directly to your loved ones, simplifying the process during a difficult time. Understanding how to properly utilize this form can help you secure your estate planning goals.

Get My Document

Transfer-on-Death Deed Form for Alabama

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.