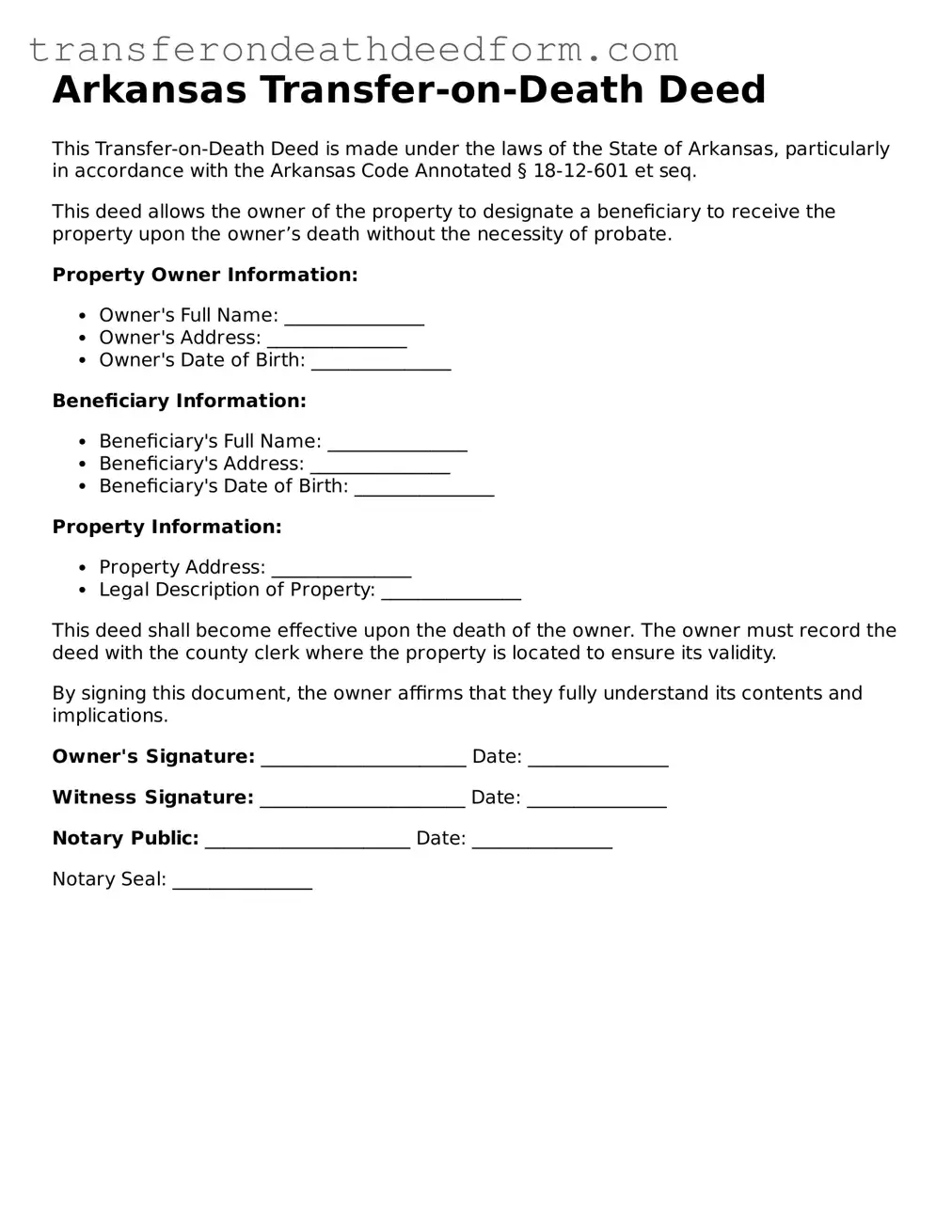

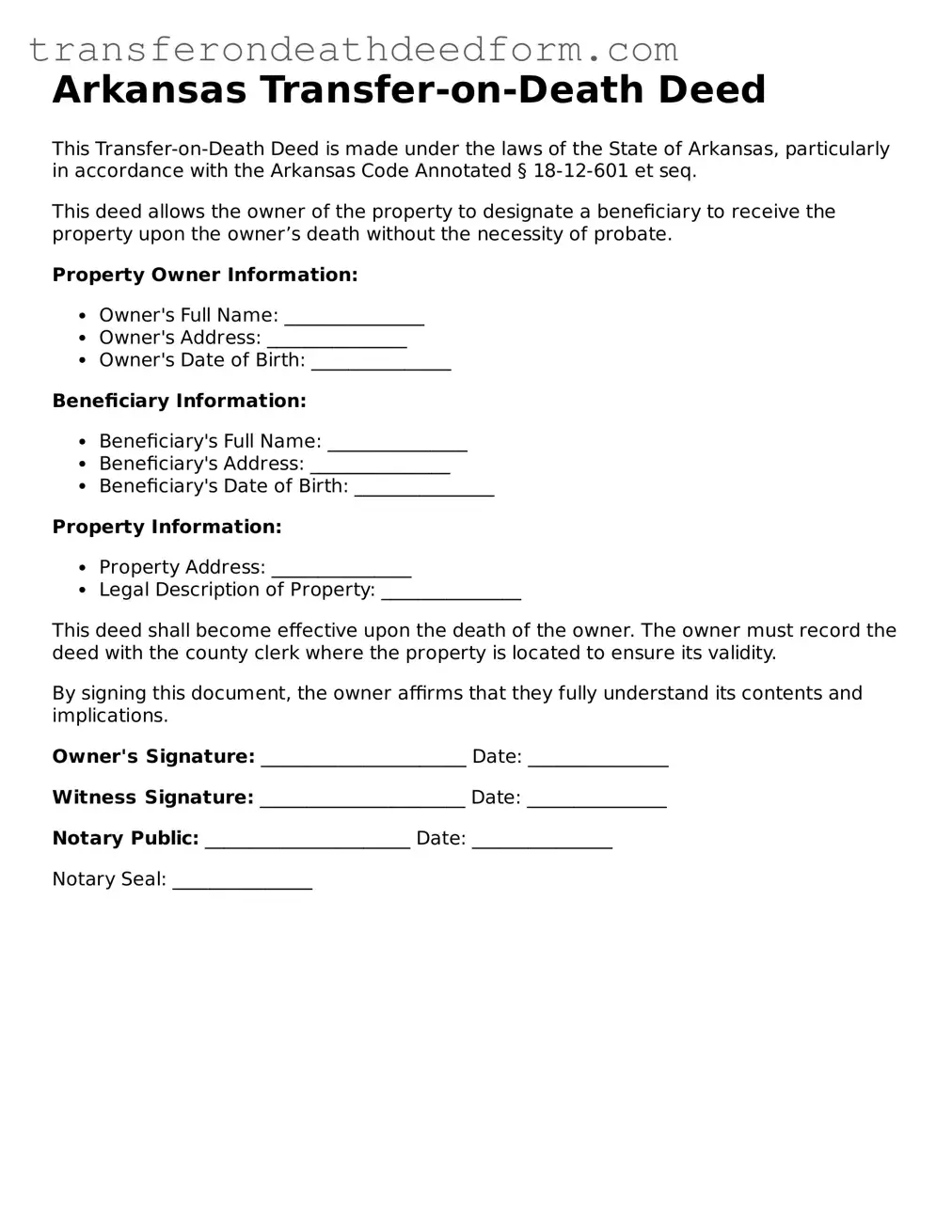

Transfer-on-Death Deed Form for Arkansas

The Arkansas Transfer-on-Death Deed form allows property owners to transfer real estate to beneficiaries upon their death, without the need for probate. This simple yet effective tool can streamline the process of passing on property, ensuring that loved ones receive their inheritance quickly and efficiently. Understanding how to properly use this form is essential for anyone looking to manage their estate planning effectively.

Get My Document

Transfer-on-Death Deed Form for Arkansas

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.