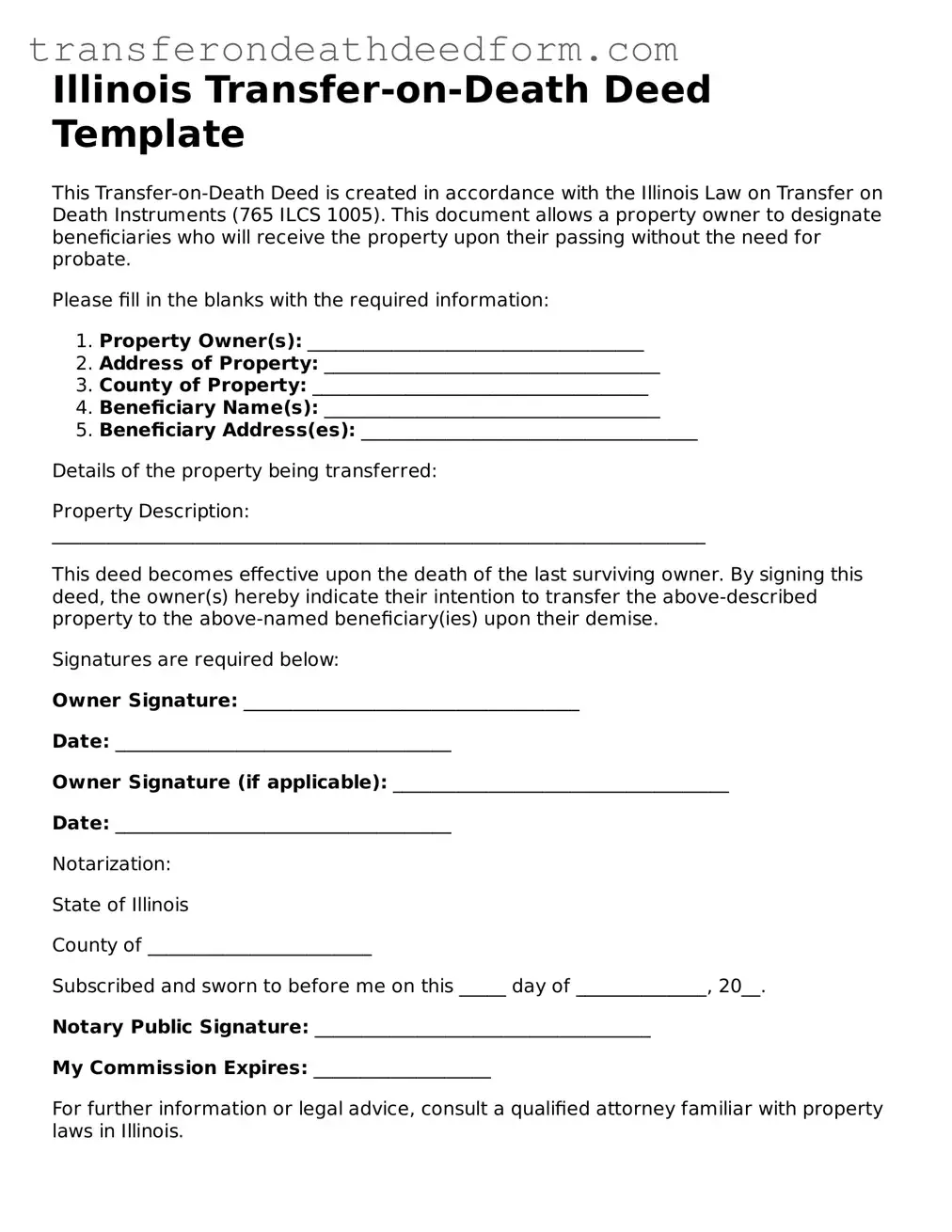

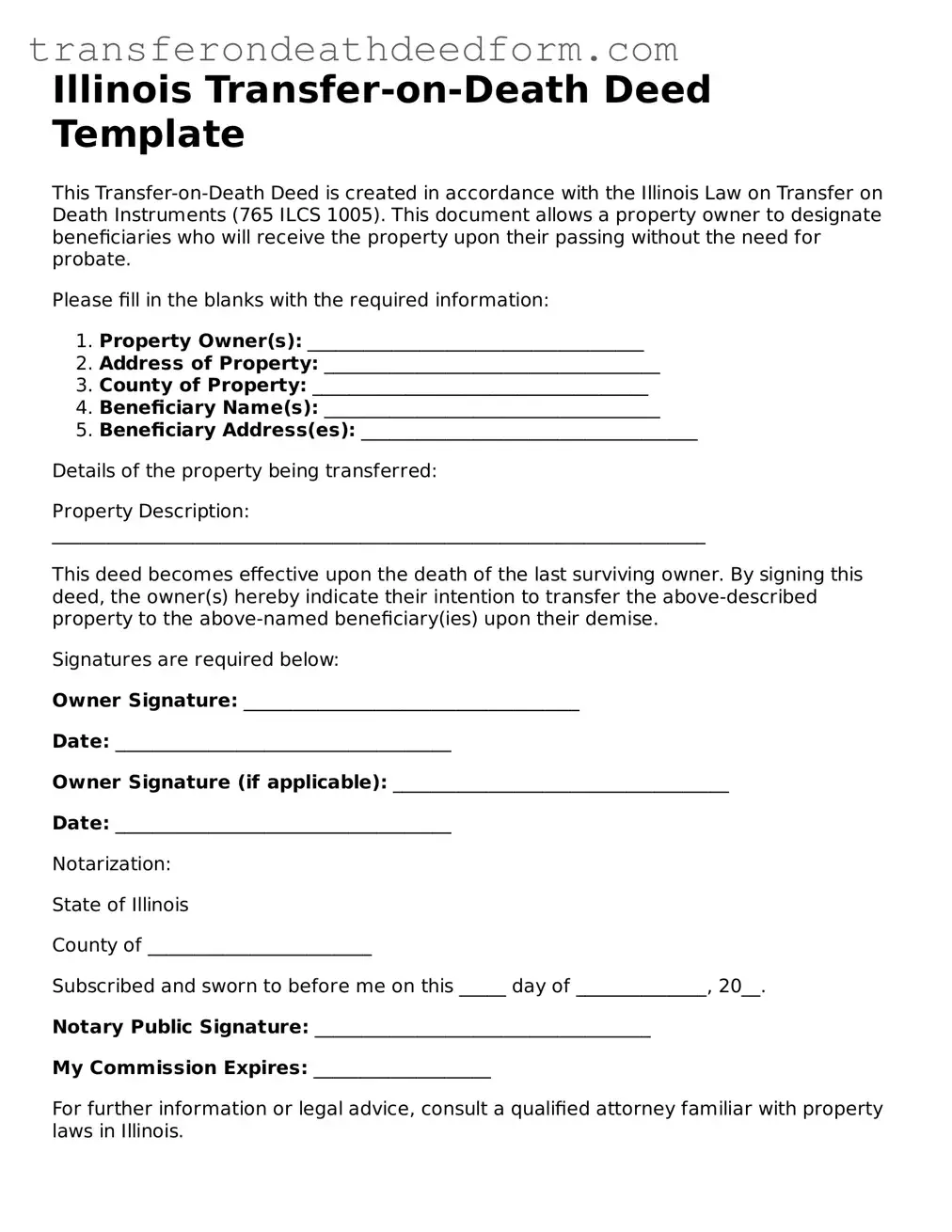

Transfer-on-Death Deed Form for Illinois

The Illinois Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This straightforward tool provides a way to transfer property without the complexities often associated with wills. Understanding its use can help individuals ensure their assets are passed on according to their wishes.

Get My Document

Transfer-on-Death Deed Form for Illinois

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.