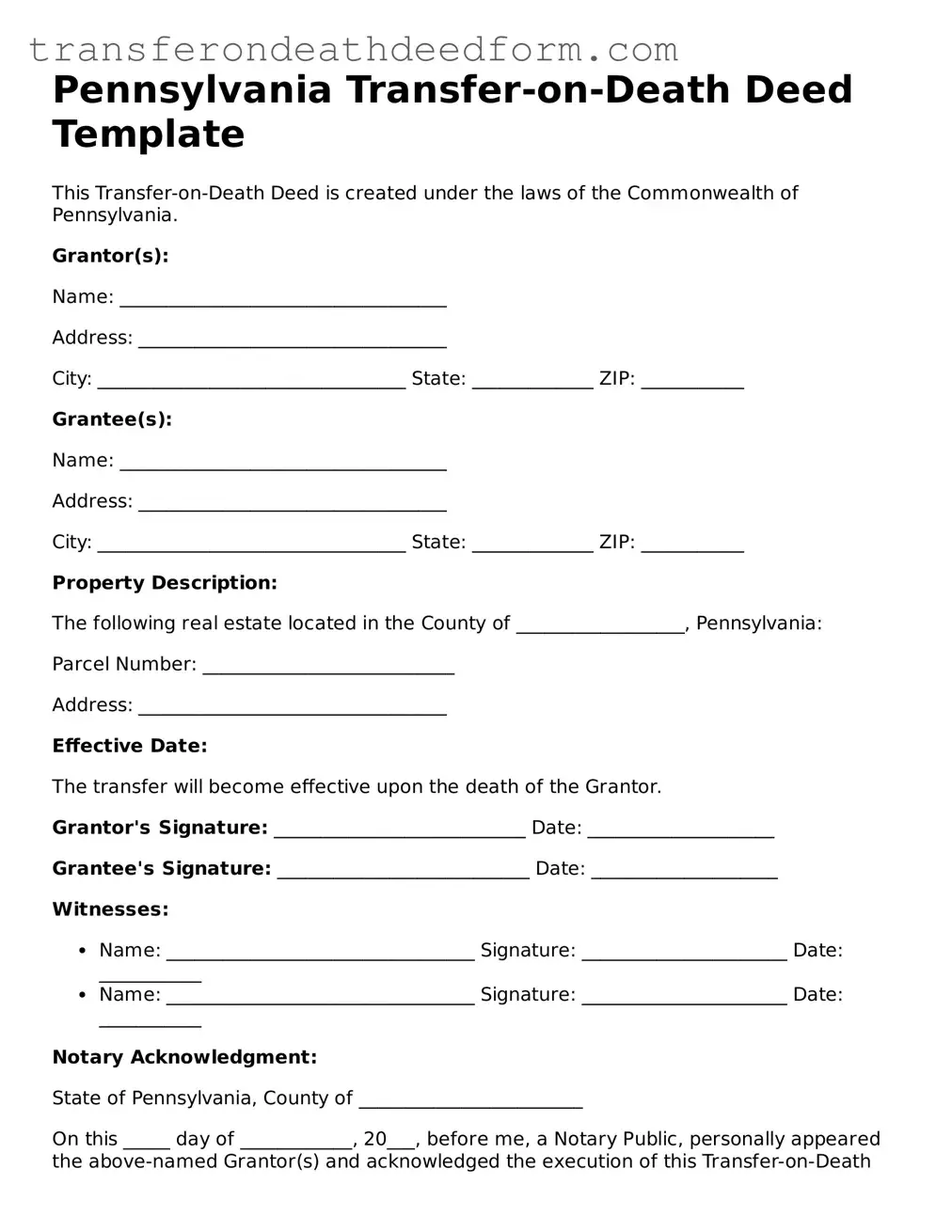

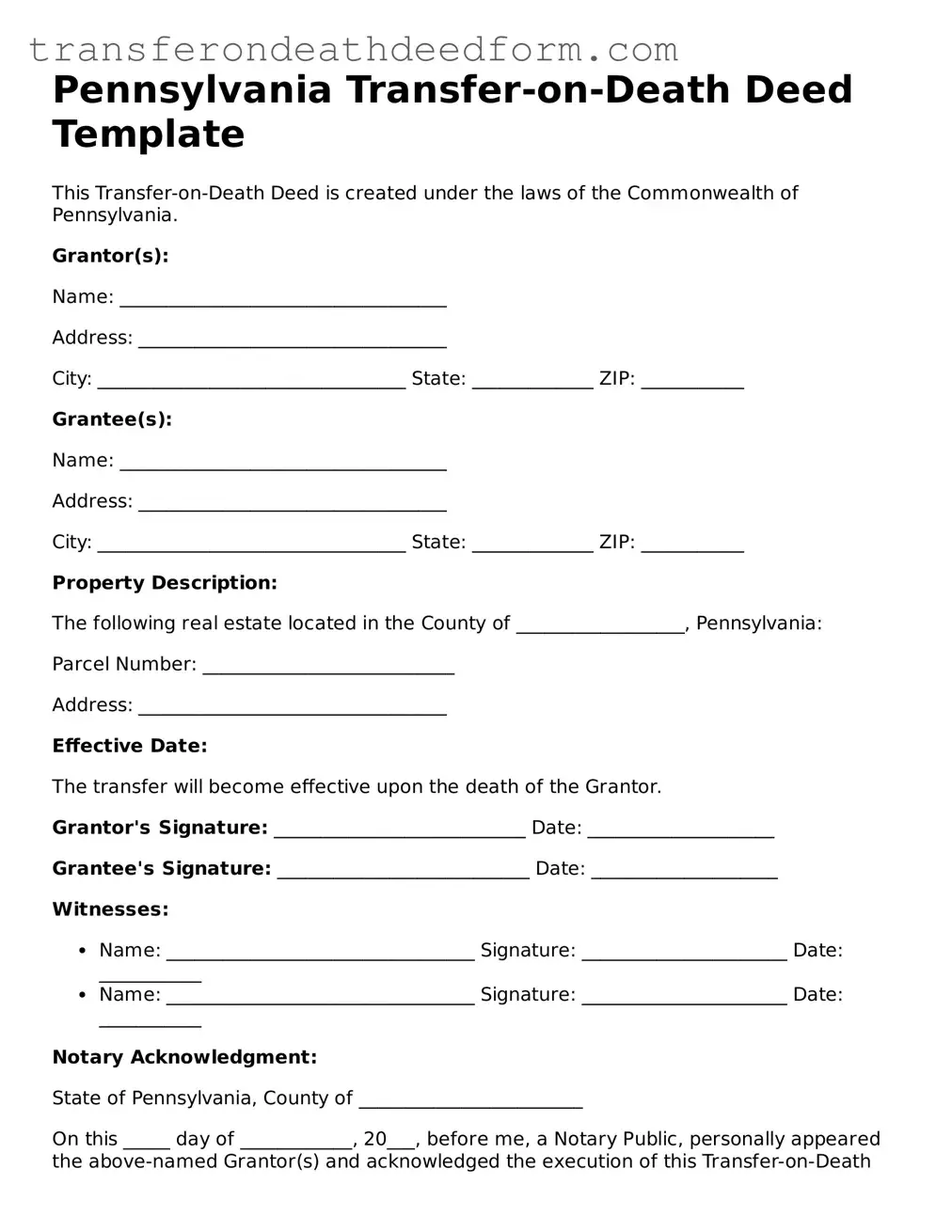

Transfer-on-Death Deed Form for Pennsylvania

The Pennsylvania Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death, bypassing the probate process. This form provides a straightforward way to ensure that your property is passed on according to your wishes. By utilizing this deed, individuals can maintain control over their property during their lifetime while simplifying the transfer for their loved ones after they are gone.

Get My Document

Transfer-on-Death Deed Form for Pennsylvania

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.