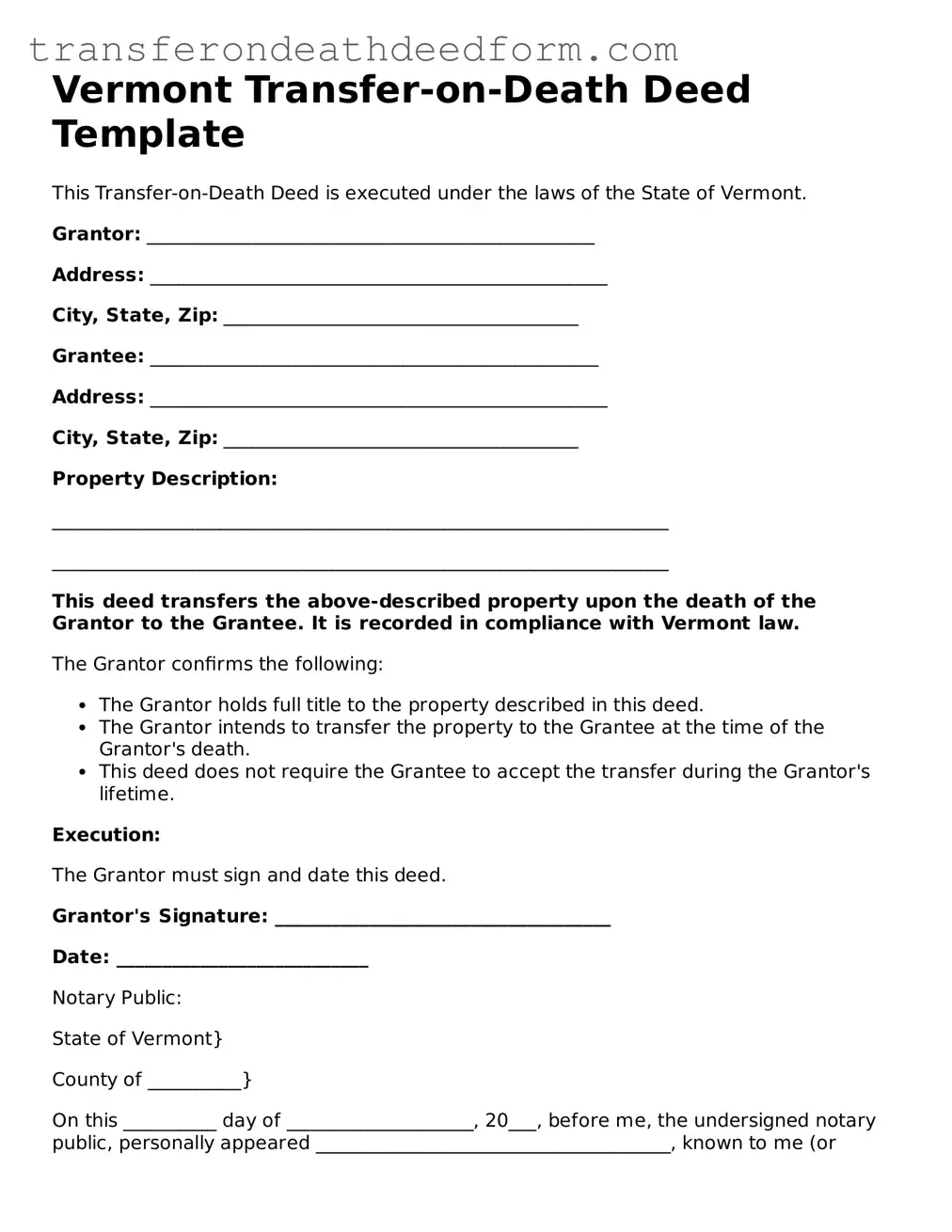

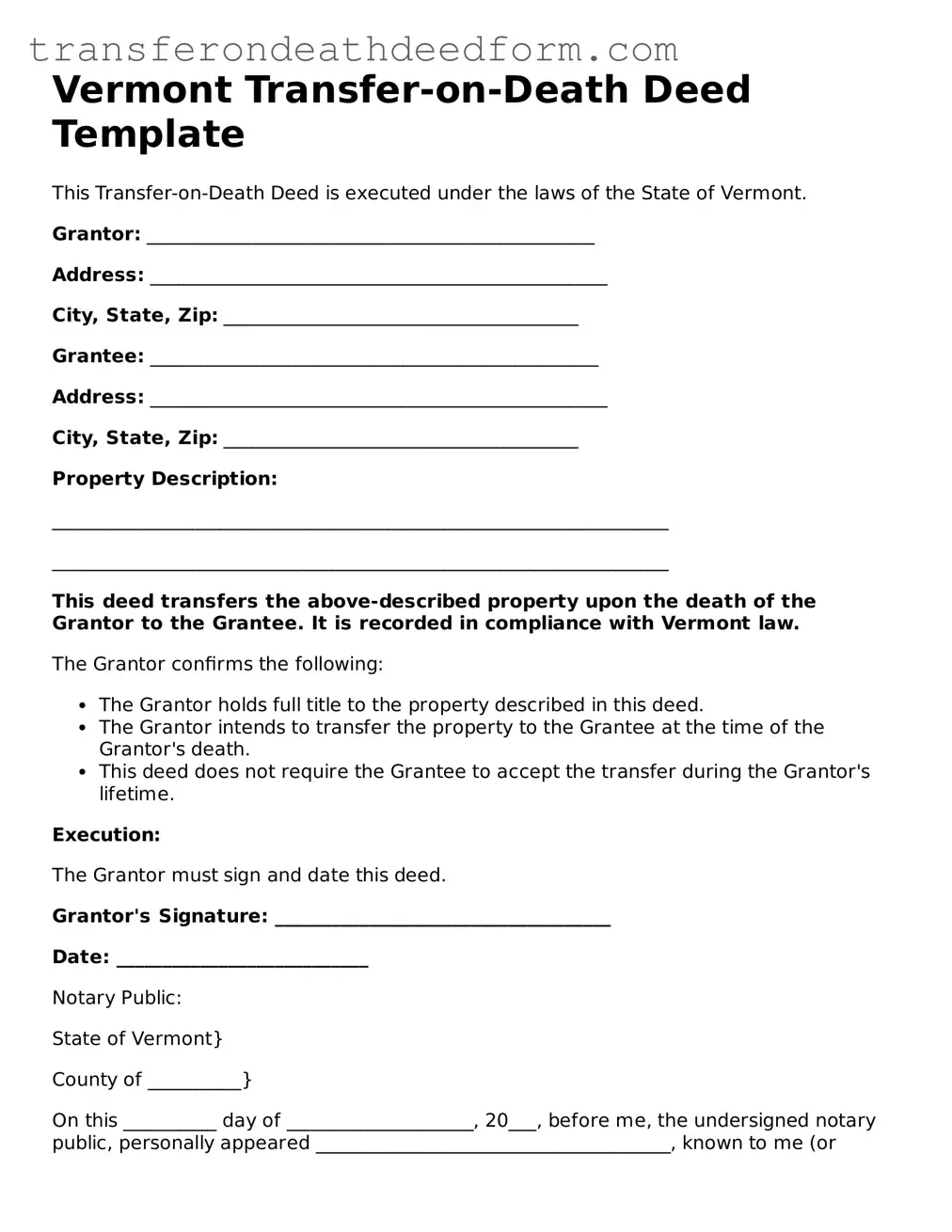

Transfer-on-Death Deed Form for Vermont

The Vermont Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death without going through probate. This straightforward tool ensures a smooth transition of property ownership while keeping the process simple and efficient. Understanding how to properly utilize this form can help you secure your estate plans and protect your loved ones.

Get My Document

Transfer-on-Death Deed Form for Vermont

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.