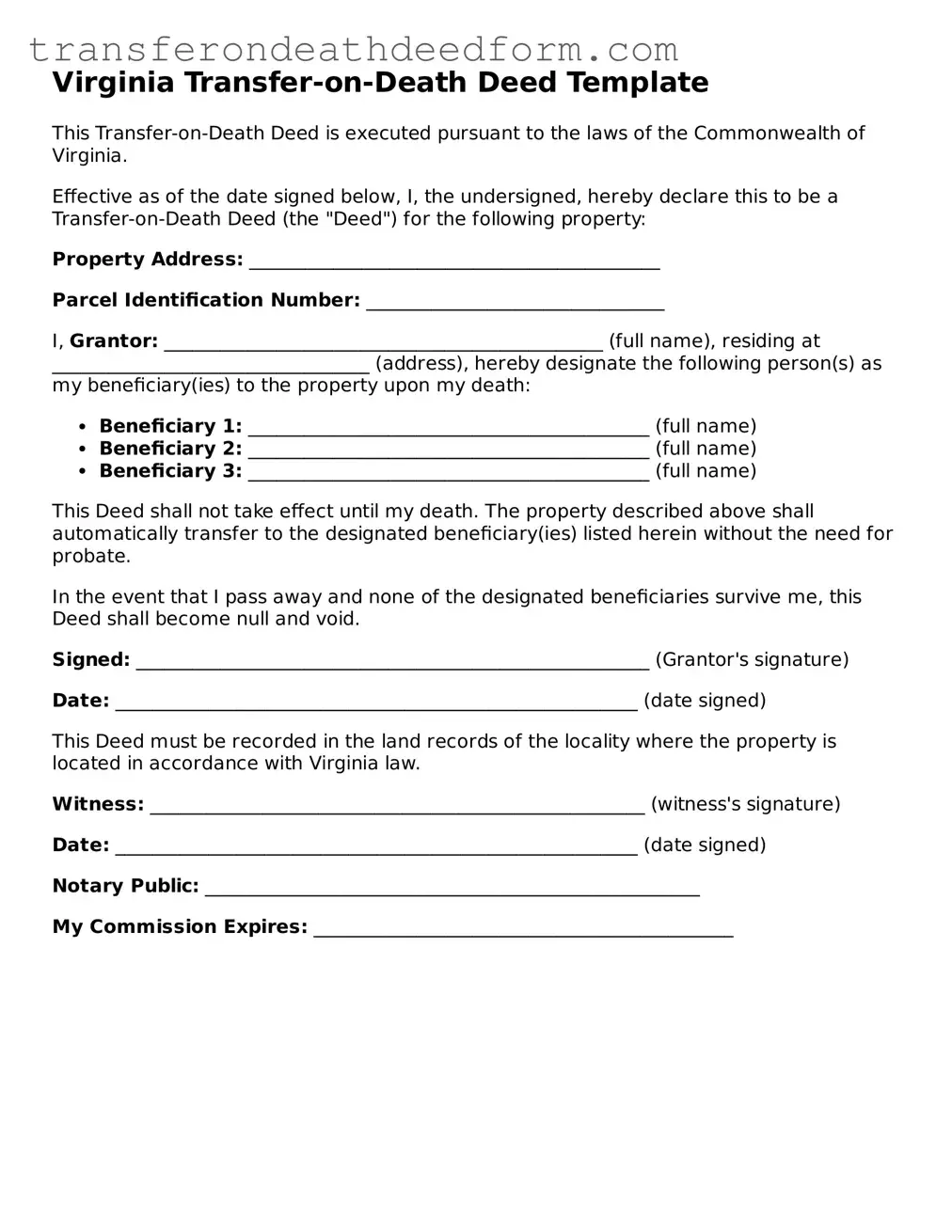

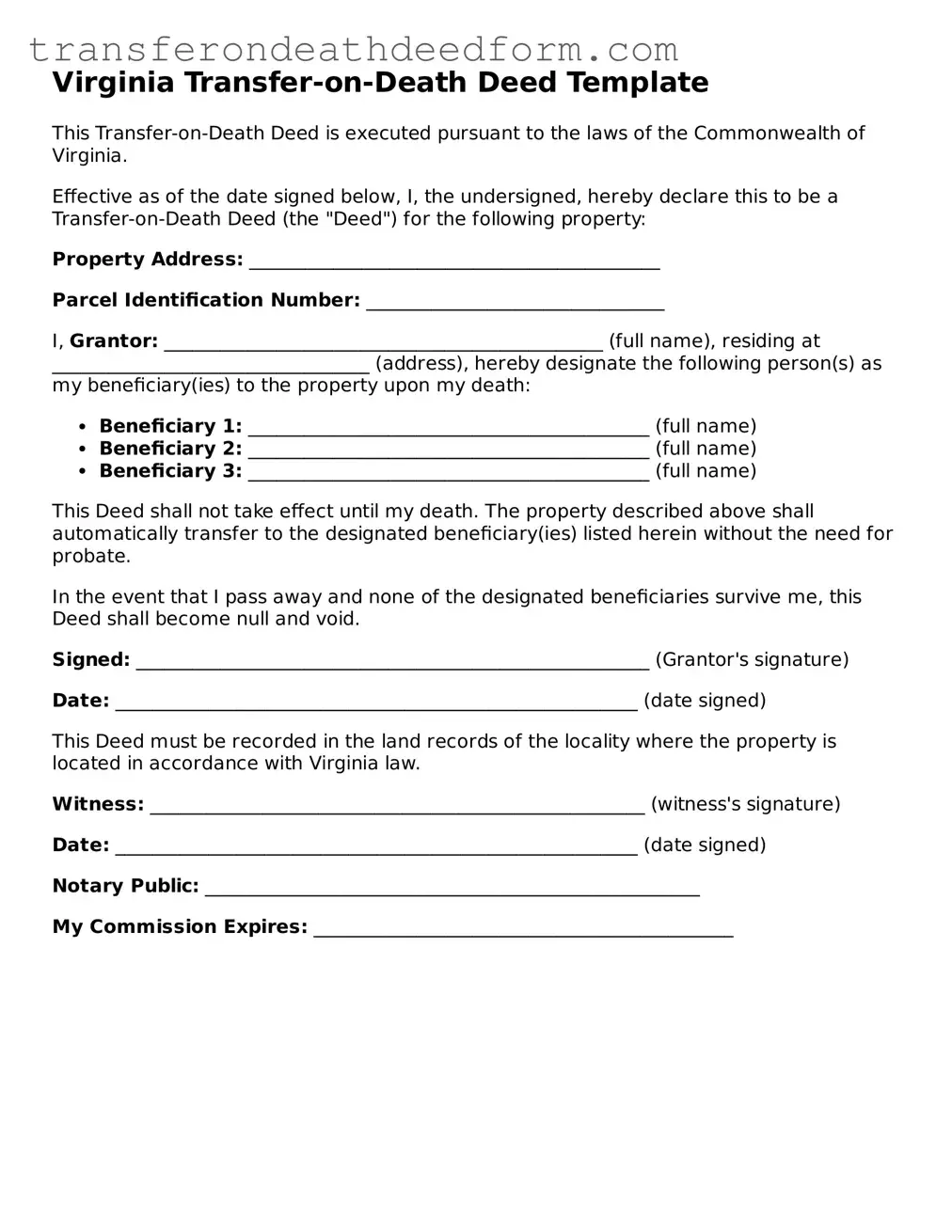

Transfer-on-Death Deed Form for Virginia

The Virginia Transfer-on-Death Deed is a legal document that allows property owners to designate beneficiaries who will automatically receive their real estate upon the owner's death, bypassing the probate process. This deed provides a straightforward way to transfer property while retaining full control during the owner's lifetime. Understanding how this form works can help individuals plan their estate more effectively and ensure their wishes are honored.

Get My Document

Transfer-on-Death Deed Form for Virginia

Get My Document

Get My Document

or

Get Transfer-on-Death Deed PDF Form

You’re in the middle of the form

Complete Transfer-on-Death Deed online — simple and paperless.